Introduction to ERDF equity financial instruments

Definition of equity financial instruments

‘The provision of capital to a firm, invested directly or indirectly in return for total or partial ownership of that firm and where the equity investor may assume some management control of the firm and may share the firm's profits.’

Embracing both Venture Capital (VC), which invests in start-ups and early stage companies, and Private Equity (PE), which targets more mature growing companies, equity investment provides a vital source of finance for growing companies in the EU.

Supporting growing companies

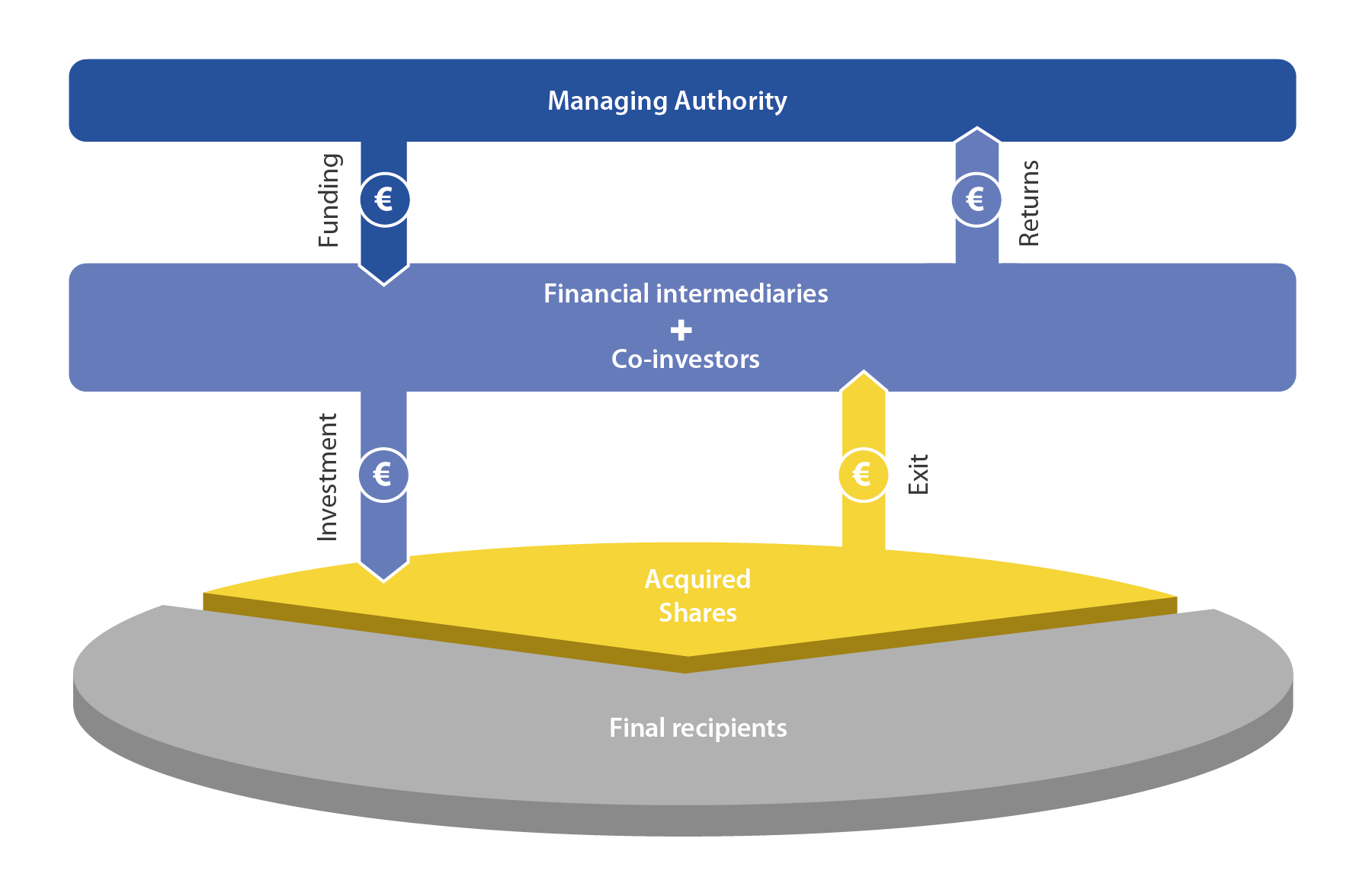

The fi-compass publication, ‘Financial Instruments products’, provides an introduction to equity investment. Here is how a typical equity investment works:

Figure 1 A typical equity investment

ERDF resources are committed by a managing authority to an equity fund (managed by a financial intermediary (or equity fund manager) that then identifies and invests the resources, alongside funds committed by other investors, into target final recipients. In return for the investment the equity fund receives a share of the ownership of the company.

Depending on the size of the investment, the Fund Manager may be granted rights to participate in the company’s strategic management (for example through a seat on the Board of Directors) and, additionally may provide further support to the management team with a view to securing the growth of the company.

After a period of growth and development (typically 4 to 10 years), the Fund Manager will seek to exit the company by selling its shares, securing a financial return on the equity investment and enabling the company to further develop its economic and financial viability.

La Financière Région Réunion

The French La Réunion region set up the ‘La Financière Région Réunion’ (FRR) fund of funds with resources from the European Regional Development Fund (ERDF) with a mandate to establish, under separate financial intermediaries, a loan fund of EUR 62 million (including private co-financing) and an equity fund with EUR 10 million to co-invest alongside private investors.

ERDF equity fund managers supported local enterprises in developing their businesses through advisory and mentoring services, provided alongside their investments. This helped the companies to expand into new territories, boosting their export activities and to better understand the different financing options.

To find out more, take a look at the case study La Financière Région Réunion - Financial instruments to support SMEs, France.

ERDF’s capacity to finance projects with higher risk profiles, attract other public and private resources and focus on the most relevant market failures on a given territory (in terms of SMEs’ sizes, risks or industrial sectors for instance), make it a very useful resource in the set-up of equity instruments.

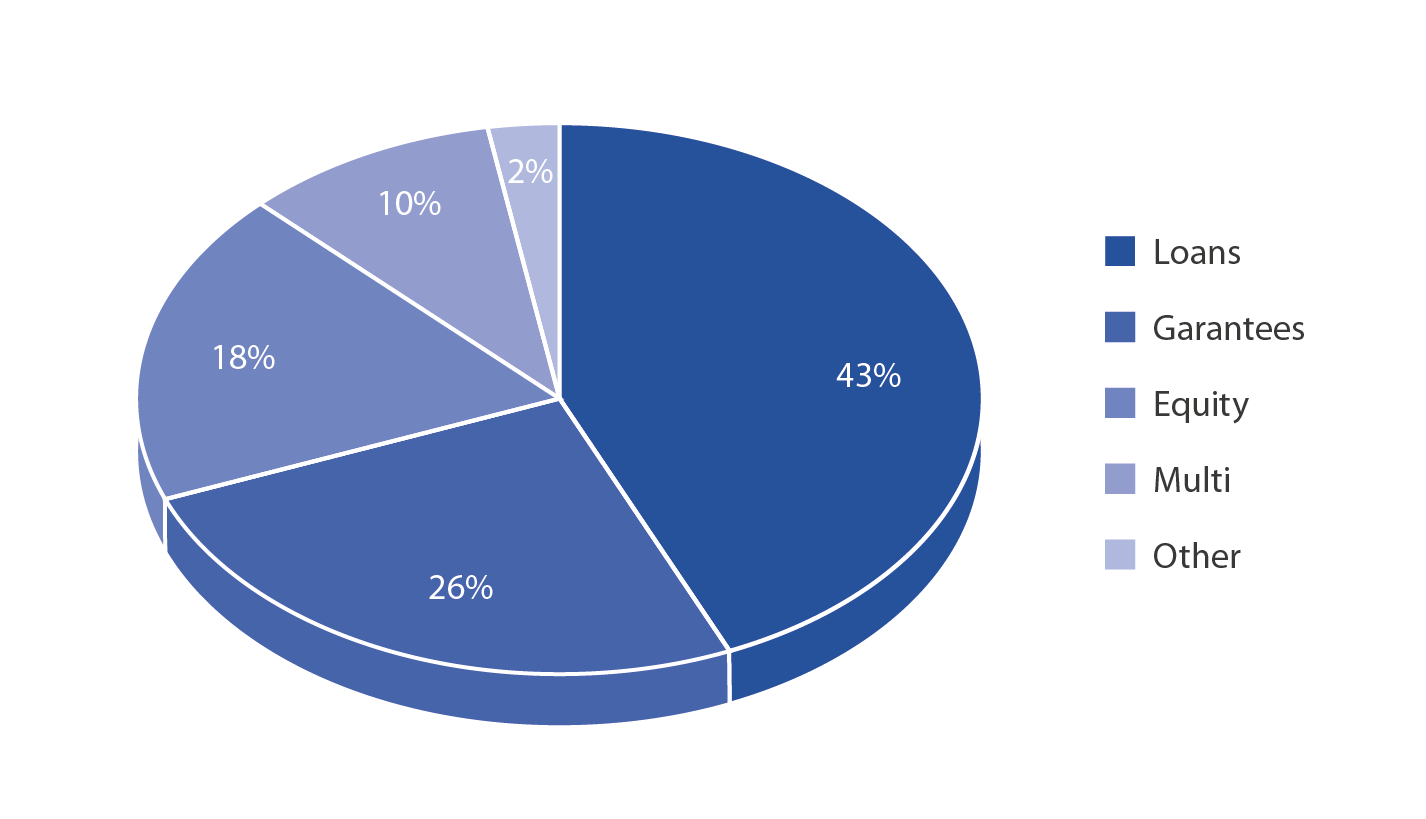

By the end of 2020, out of the EUR 22.4 billion total ERDF programme resources committed to financial instruments, EUR 4.5 billion was related to those providing equity, financing over 3 000 SMEs. The average programme amount committed to equity financial instruments (FIs) was EUR 21 million.

Figure 2 Programme amounts committed to FIs by product, as of end 2020