Key market features

Different financing needs throughout the lifecycle

The financing needs of SMEs change throughout their lifecycle and depend on factors such as their age, the maturity of their products, their growth strategy and their capacity of absorption. Depending on these factors, grants, debt, equity or a combination of these different types of financing can be the more relevant type of funding.

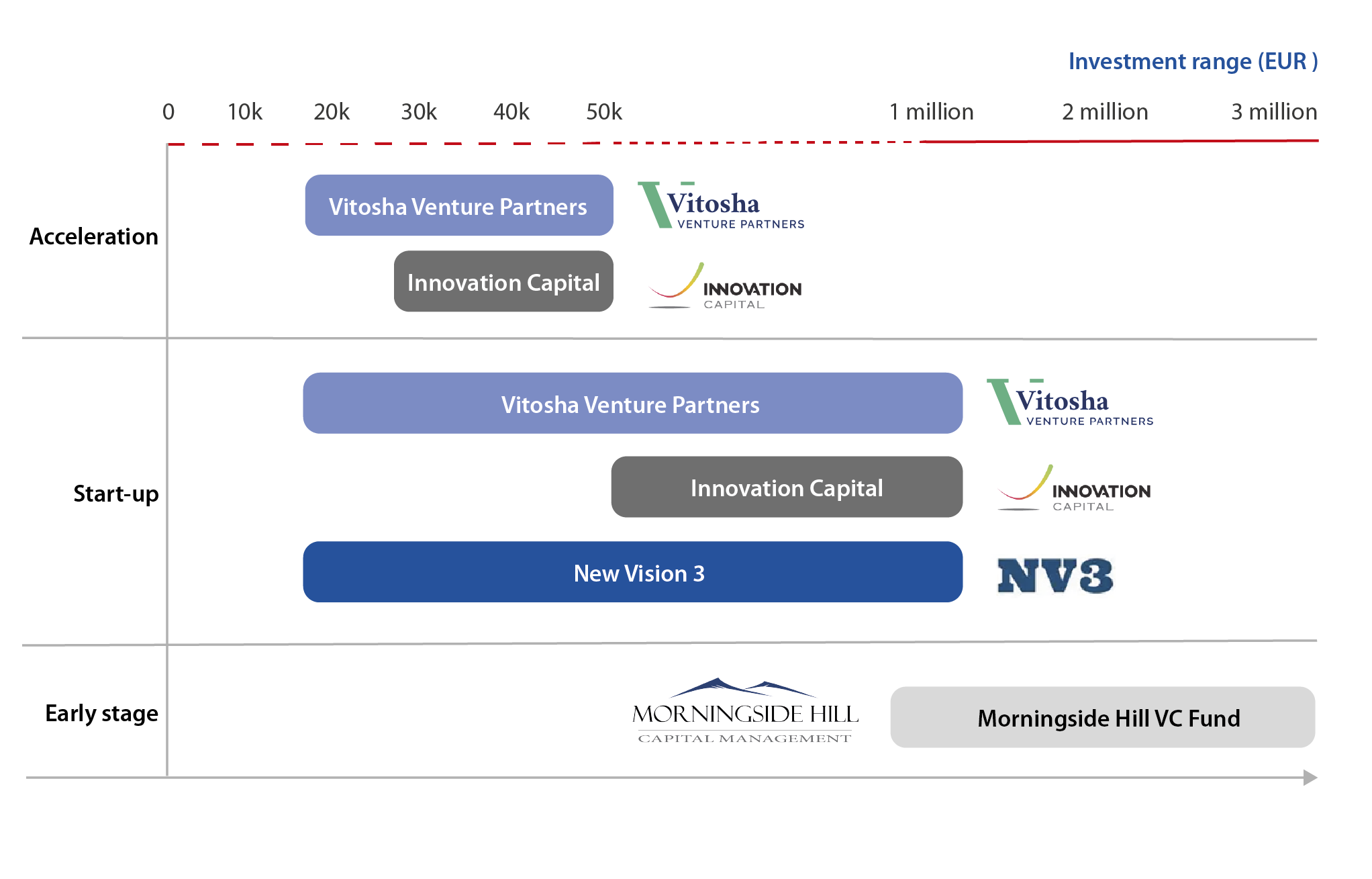

The image shows how the financial instruments ensure that support is available to Bulgarian companies at all stages of their business lifecycle.

Equity financial instruments in Bulgaria – from Seed financing to Scale-up

Four equity financial instruments set up by the Fund Manager of Financial Instruments in Bulgaria (FMFIB) provide equity and quasi-equity investment to support new business ideas, start-ups and early stage companies, with the VC Fund providing growing companies seeking to expand with access to additional investment.

A feature of the FMFIB ‘Innovation and Competitiveness’ financial instruments, is the overlap of the Investment Strategies between the financial instruments with several different funds targeting investments in similar types of businesses. This results in greater flexibility of the investment approach implemented by the fund managers, but also allows for a degree of competition between the different funds, ensuring financing is made available at the most advantageous terms for the target companies.

Find out more, read the fi-compass case study: FMFIB: Fund Manager of Financial Instruments in Bulgaria – a multi-sector fund of funds.

Watch an interview with FMFIB to discover more about these instruments:

Figure 5: Business lifecycle and equity investment types

The types of equity investment normally depend on the stage of a company’s development (new vs. mature) and on the investment model (co-investor in the fund portfolio or in individual investments, on a deal-by-deal basis). Investments are often described by the relevant phase, namely research and development, start-up, early Growth, expansion, mature age, and crisis or decline, as shown below.

Each of these stages can be linked to a different category of equity investment, a different market and a different risk-return profile, as follows:

Seed

The first phase of the business lifecycle is when the founding entrepreneurs start to create and develop the business idea.

🡆 The corresponding equity investment is seed financing.

Startup

This phase entails the concrete outset of business activities.

🡆 For this phase, the equity investment is called startup financing.

Early Growth

Also known among equity practitioners as ‘the financing of the day after’, this is the stage when a company begins to grow.

🡆 The equity investment is the early growth financing.

Expansion

As the name suggests, this phase entails a company’s sales growing steadily and consistently.

🡆 The corresponding equity investment is called expansion financing.

Normally, equity investors invest in companies that are in any of the first four phases.

Mature age

After growing at a rapid pace in the expansion phase, the rate of sales stabilise.

🡆 The equity investment is called replacement.

Crisis or Decline

Eventually, should a company encounter a severe crisis and/or begin its decline, it will have serious difficulties in attracting any equity investment.

🡆 If such an equity investment materialises, it is the so-called vulture financing.