Key market features

Loan financial instruments

General characteristics of loan instruments

Loan financial instruments offer several features that make them appealing and practical investment vehicles.

Decreased exposure for investors: by spreading investments across multiple projects or loans, these instruments reduce concentration risk and limit the impact of individual defaults on overall investment portfolios. This decreased exposure allows investors to participate in a broader range of projects and diversify their portfolios without significantly increasing their risk-taking capacity.

Enhanced liquidity: compared to direct lending arrangements, pooling funds from multiple investors facilitates easier entry and exit into investments, offering investors greater flexibility and improved liquidity management capabilities.

Stable returns: due to their fixed-income nature, these instruments offer predictable income streams that can be appealing to investors seeking regular cash flows with minimal volatility.

Access to diverse investment opportunities across various sectors and geographical regions: investors can select investments based on their risk appetite and preferences, allowing for effective diversification and risk management strategies. Transparent risk assessment processes and clear reporting mechanisms enhance investor confidence and enable better evaluation of the risk-return dynamics associated with each investment.

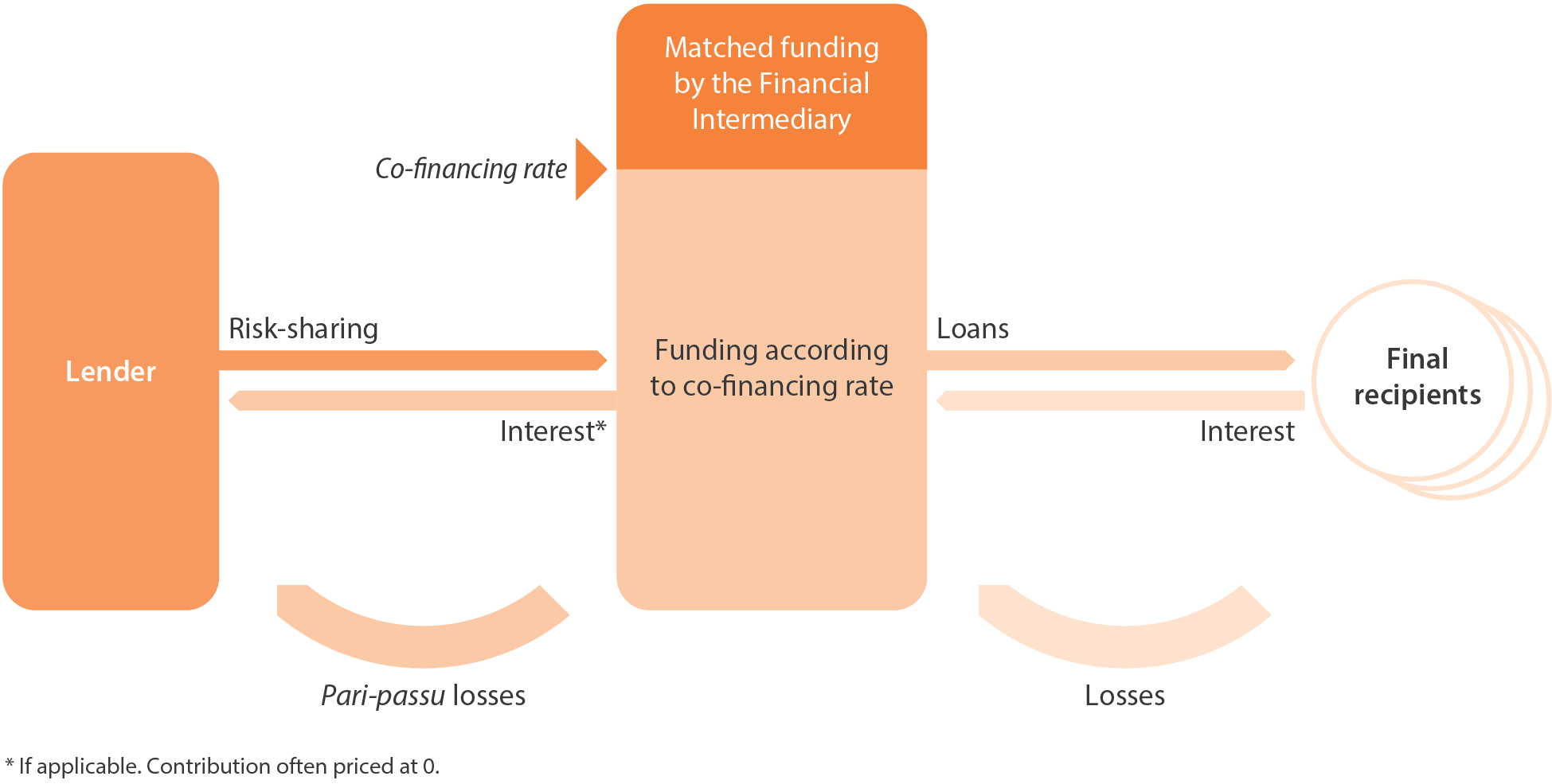

Figure 7 Portfolio Risk-Sharing Loan model

The Risk sharing loan model

In a risk sharing loan instrument, resources contributed from ERDF programme resources and funds from the financial intermediary are pooled together providing credit risk sharing to the latter with the ultimate aim of improving access to finance to targeted SMEs.

The risk would always be shared in agreed proportion (i.e. the co-investment rate) as a way to align the interest between the parties.

As a result of the risk sharing, if a default occurs at the level of final recipients, the loss to be borne by the body implementing the financial instrument can be significantly reduced.

Research and Innovation Funds in Italy, ERDF loan and equity financial instruments

The fi-compass case study on the financial instruments set up by the Italian Ministry of Universities and Research (MUR) describes how both loan and equity financial instruments were developed to support innovative companies (small and large) in Southern Italy.

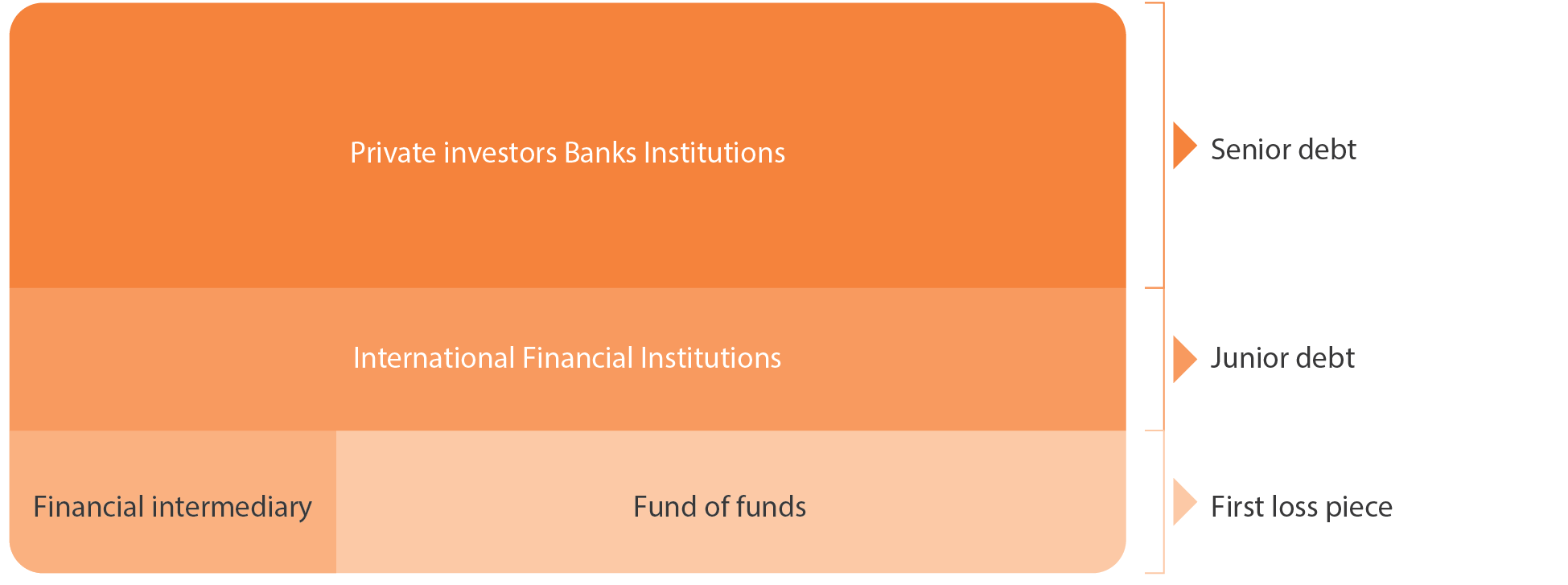

Layered investment platform - tranching co-investment

A more complex type of risk sharing loan is a layered investment platform which provides a structure of tranches which enables private investors to contribute financing at a lower risk.

The tranching enables the financial instrument to attract a range of investors with different appetite for risk and return.

First-loss piece made up of contributions from ERDF and the financial intermediary (on pari passu terms). This tranche has the highest risk level since all the defaults in the underlying loan portfolio would first result in losses for this layer of funding.

Junior debt (e.g. from International Financial Institutions). This is a lower risk layer but acts as a further credit enhancement protection for the senior debt layer.

Senior debt (e.g. from commercial banks). The lowest risk layer since any losses would only be incurred in the relatively unlikely event that the defaults in the loan portfolio exceeded the other layers.

Figure 9 The Lithuanian Leveraged Fund investment platform