Key market features

Equity investors

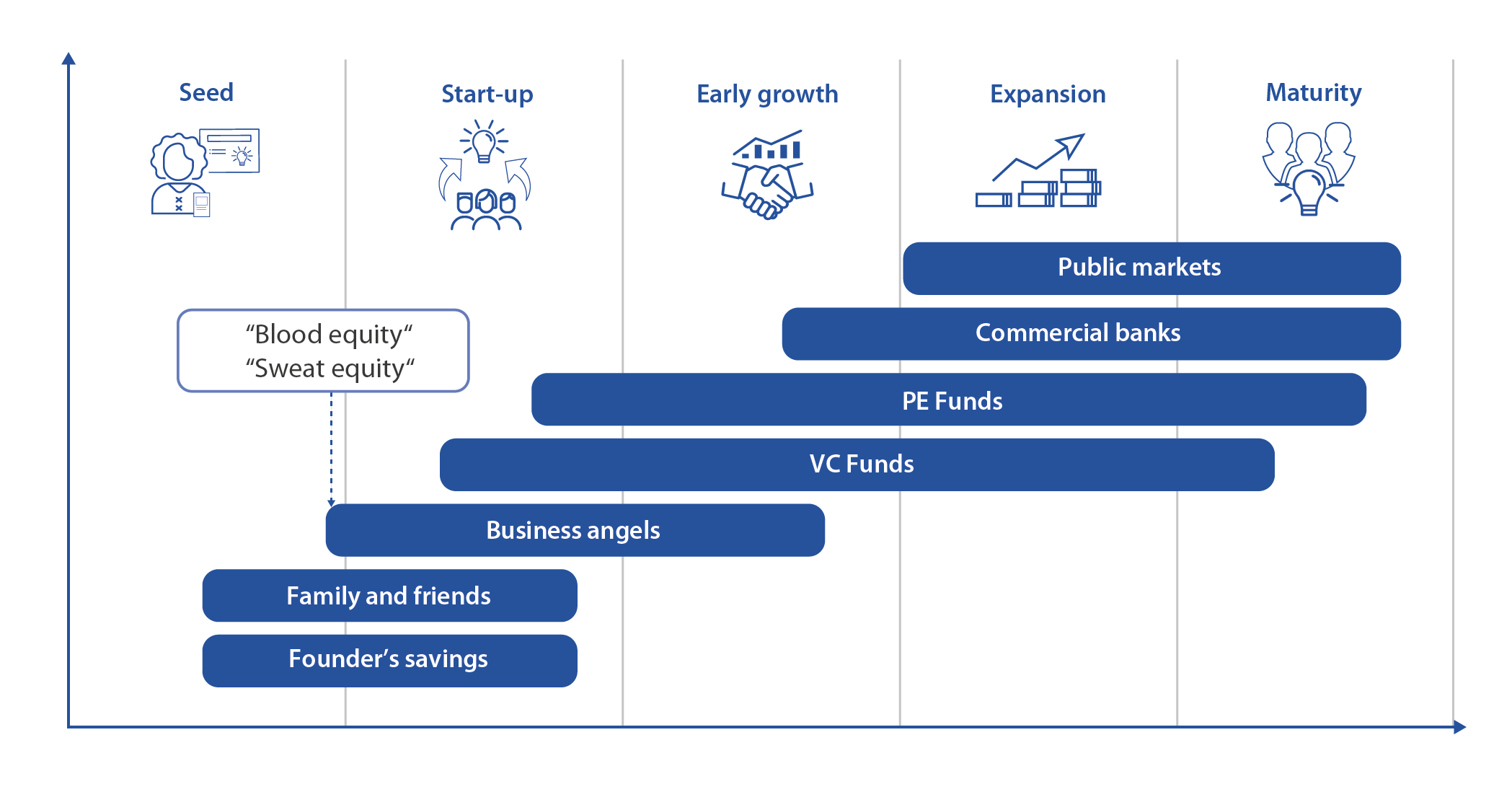

Equity investors can range from the entrepreneur’s family and friends to a large private equity house. An early-stage company that only needs a small investment may be able to meet its needs from the families and friends of the entrepreneur/founder and employees (so called ‘blood’ and ‘sweat’ equity).

Business Angels can play a vital role in supporting growing businesses, as they seek their first external investment. Typically high-net-worth individuals, Business Angels can provide patient equity to start-ups, together with know-how, advice and contacts.

As companies continue to grow their investor profile will develop. Larger, growth-stage businesses will need investors with more money, such as venture capital (VC) funds. Larger companies might turn to private equity or large corporations. This may happen before acquisition or a stock exchange listing through an initial public offering (IPO).

Figure 4 shows the different types of investors and the stage in a company’s lifecycle where they may be most needed.

Figure 4: Types of equity investors through a company’s lifecycle

Equity investments are usually made with a fixed investment horizon, typically ranging from four to ten years, at which point the equity fund hopes to profitably exit the investment. Exit strategies include IPOs and sale of the business to another equity fund or strategic buyer.

A tech start-up heading for the Big League

Roboze is an ambitious growing company from Southern Italy that is shaping a worldwide ‘manufacturing as a service’ network.

Supported by a EUR 3 million investment from an ERDF equity financial instrument set up in Italy by the Ministry for Universities and Research, the company has been able to recruit additional staff and further develop its technology.