Key market features

Venture capital vs. Private equity

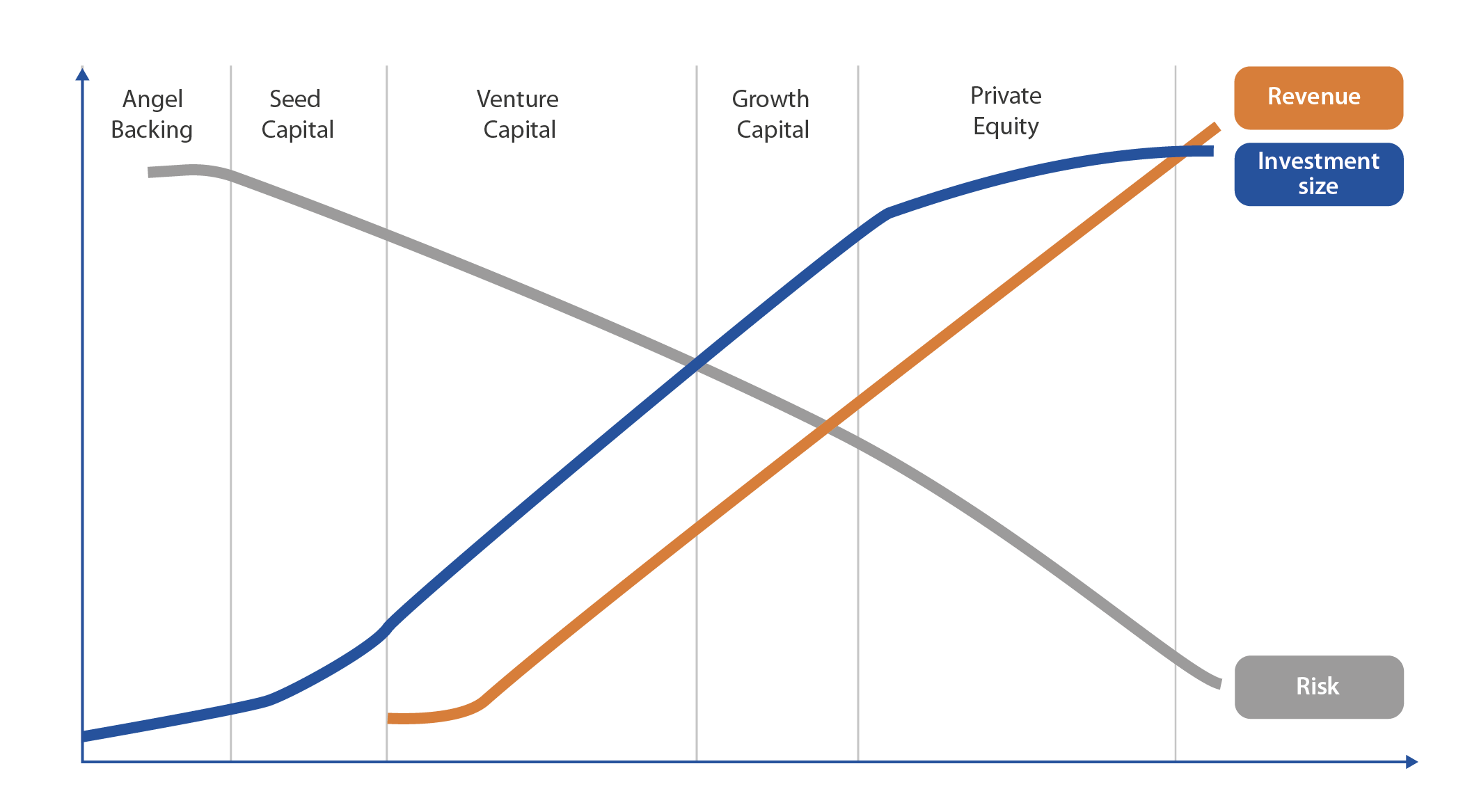

Equity investment encompasses a number of different investment strategies, as Figure 6 shows. However, when used at the investment level there are key differences between venture capital (VC) and private equity (PE) investments; foremost of which is the maturity of the portfolio companies in which they invest.

Venture capital investments are characterised by providing capital to young, start-up, or early stage businesses that are or have the potential to grow quickly. VC investments are usually made through iterative rounds of financing with additional capital provided as growth/return on investment is achieved. PE investments are typically in larger, more mature businesses with proven financial record.

Figure 6: Differences between venture capital and private equity

Exit strategies

When the time is right, equity investment managers liquidate or dispose of their investment portfolios to secure a financial return and enable the company to realise its potential and consolidate its economic and financial viability. This last crucial step in the equity investment process is called 'exit strategy'.

When deciding to exit, equity funds take one of four routes:

Total exit

From the business, through a trade sale to another buyer, leveraged buyout (LBO) from another PE firm, or a share buyback.

Partial exits

Such as through a private placement, where another investor buys a piece of the business or corporate restructuring, where outside investors get involved and increase their position in the business by partially buying out the equity fund.

Flotation or IPO

It is a hybrid strategy of both total and partial exit, involving the company being listed on a public stock exchange. Typically, only a fraction of a company is sold in an IPO, ranging from 25% to 50% of the business.

Liquidation and sale of assets

It provides an exit strategy in the event that the company has failed and is defaulting, providing a mechanism for realising the value of underlying assets of the company.

Matooma: a European success story backed by an ERDF financial instrument

SAS JEREMIE Languedoc-Roussillon is a co-investment venture capital vehicle which takes equity in technology-based small and medium-sized enterprises (SMEs). In 2013, it invested EUR 650 000 in a technology company called Matooma that was developing SIM cards for use in connection with ‘Internet of Things’ technology. In 2019, the equity fund was able to exit the investment at a significant profit following the Trade Sale of the company to a larger organisation.

Under the terms of the sale, the company continued to develop and grow from its base in Montpellier in the South of France. The sale by the ERDF equity fund of its stake in the company also resulted in a significant return on the original investment. These resources can now be reinvested to support new enterprises in the region, highlighting how the revolving nature of shared management financial instruments delivers real added value to managing authorities.

Find out more, read the blog story on the Matooma exit: Matooma: a European success story backed by an ERDF financial instrument.

For more information about financial instruments in the Occitanie region of France please see the fi-compass case studies, FOSTER TPE-PME-AGRI a new generation multi-sector fund of funds, Occitanie, France and SAS JEREMIE Languedoc-Roussillon.