The ERDF perspective

Supporting the growth of an equity ecosystem

What is an equity ecosystem?

In order to establish a sustainable, thriving VC/PE sector it is essential to attract and connect a range of organisations, resources and expertise. At the heart of a thriving equity ecosystem are entrepreneurs seeking to establish innovative enterprises with high growth potential and investors seeking to finance the growth of these companies. Skilled fund managers connect investors and entrepreneurs, identify investment opportunities and mobilise capital to SMEs, as well as support the growth of their portfolio companies.

In addition, wider professional services, including legal and financial advisors, public sector (including EU level) support, Business Angels and financial institutions are all important factors that contribute to the success of a region’s VC/PE sector.

The implementation of ERDF equity financial instruments is a powerful tool for managing authorities seeking to stimulate the development of the equity ecosystem in their region. The selection process for financial intermediaries has resulted in the creation of ‘first time teams’ of fund managers, often returning to their countries. The set up and implementation of the funds requires support from local professional teams, creating opportunities to boost capacity within advisers to work with equity instruments. As funds are launched, the availability of finance stimulates demand, incentivising entrepreneurial activity and creating opportunities for investors both from inside and outside the managing authority’s region.

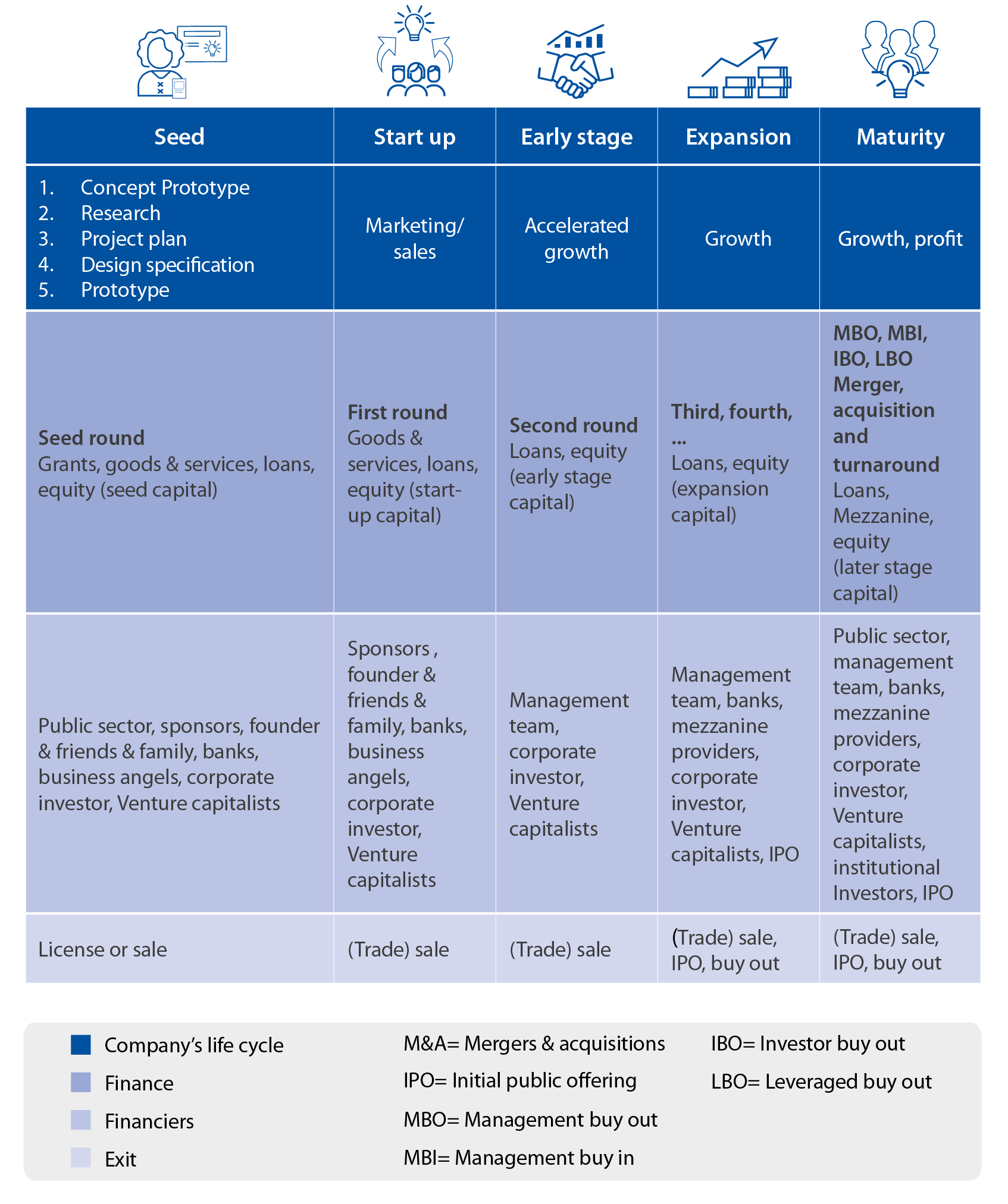

Figure 7 summarises the needs and opportunities for different actors in a thriving equity finance ecosystem. It highlights the complexities of a mature equity ecosystem and the economic and financial activities and stakeholders involved.

Figure 7: Summary of the equity ecosystem

EquiFund, Greece

Creating an equity investment ecosystem in Greece

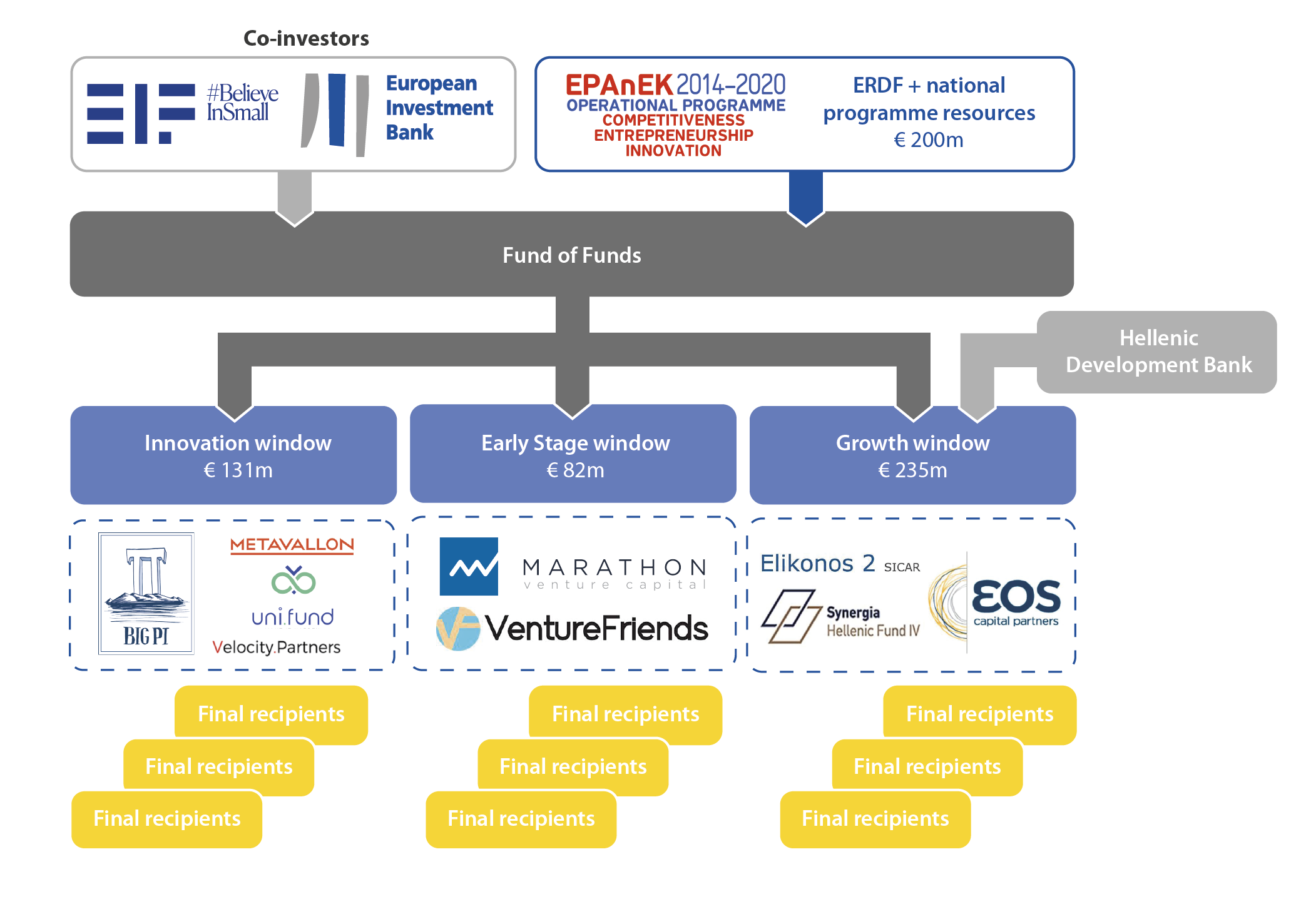

EquiFund is an ERDF fund of funds in Greece with an overall volume of EUR 448 million and nine equity financial instruments. Its mission is to provide access to equity financing for companies established or with a branch in Greece and to accelerate the development of venture capital (VC) and private equity (PE) in Greece.

All but one of the nine fund manager teams selected to manage EquiFund financial instruments are so-called ‘first time teams’. This has created opportunities for recruiting additional fund management expertise to the market, attracting specialists to Greece, in turn enhancing the capacity within the country. Financial intermediaries have also attracted significant interest from private investors and the professional sector supporting VC/PE funds has grown, together with the awareness within the business community of the potential for equity financing to support the growth of businesses.

For more information read the fi-compass case study, Equity financing for SMEs in Greece – EquiFund.

Design of EquiFund, Greece