The European Social Fund Plus

The European Social Fund Plus (ESF+) is the European Union’s main instrument for investing in people. With a budget of almost EUR 99.3 billion for the period of 2021-2027, the ESF+ will provide an important contribution to the EU’s employment, social, education and skills policies, including structural reforms in these areas.

The European Commission adopted its new ESF+ Regulation (regulation EU 2021/1057) on 30 June 2021. The new 'simpler but stronger’ version of the existing European Social Fund will concentrate on the challenges identified under the European Semester, in particular in order to meet social and employment challenges following the COVID-19 outbreak and with a strengthened focus on social innovation. The COVID-19 pandemic has reversed gains in labour participation, challenged educational and health systems and increased inequalities. The ESF+ will be one of the key EU instruments helping Member States to address these challenges.

ESF+ brings together four funding instruments, originally separated in the 2014-2020 programing period including: the European Social Fund (ESF); the Fund for European Aid to the most Deprived (FEAD); the Youth Employment Initiative; and the European Programme for Employment and Social Innovation (EaSI).

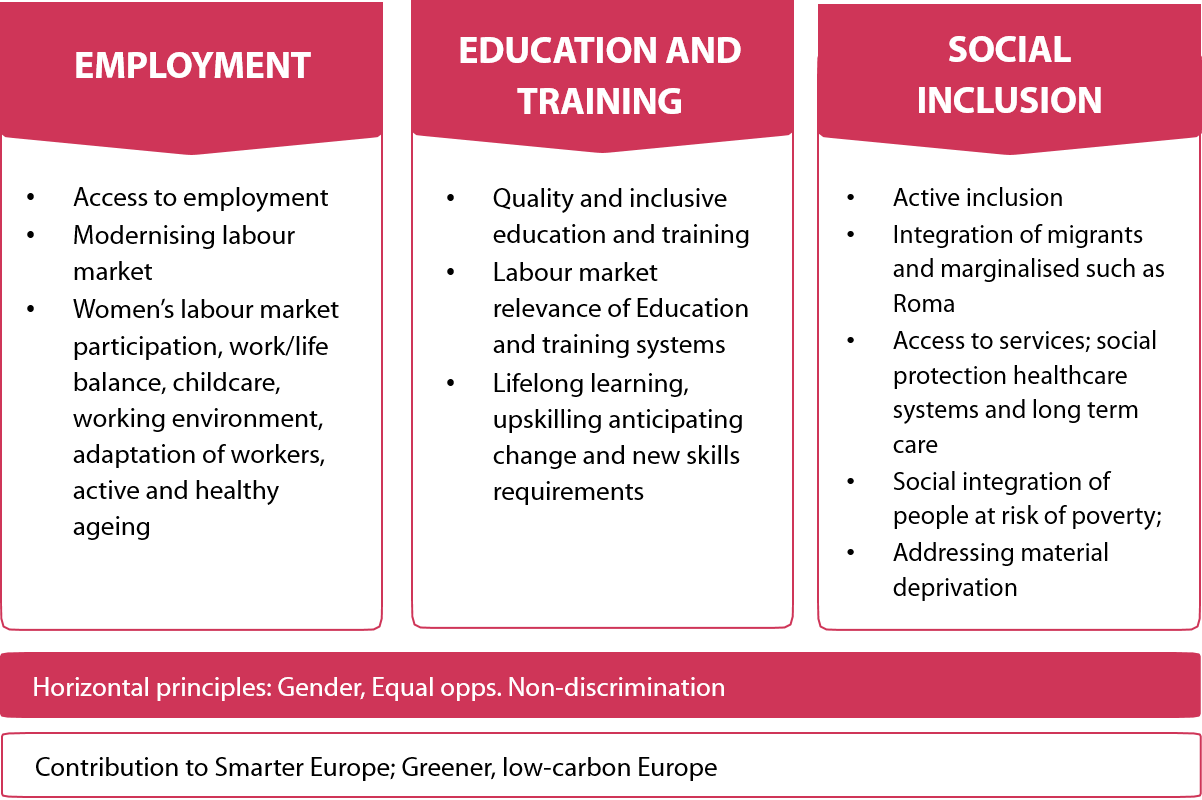

ESF+ will aim to strengthen Europe’s social dimension, by putting the principles of the European Pillar of Social Rights into practice through 11 specific objectives.

The European Commission’s support in the social economy sphere has been stepped up recently, with the adoption of the Social Economy Action Plan. It aims to help the European social economy thrive, tapping into its economic and job-creation potential, as well as its contribution to a fair and inclusive recovery, and the green and digital transitions.

For further information about ESF+, please visit the ESF+ website.

For preliminary information about financial instruments under the ESF, please consult the fi-compass factsheet on ESF financial instruments.

Recent videos

FI Campus 2025 – Day 1

This recording presents Day 1 of FI Campus 2025, the opening day of the flagship event organised by the European Commission and the European Investment Bank (EIB) in Brussels on 25–27 November 2025, celebrating 10 years of fi-compass. The day sets the scene by reflecting on the evolution of financial instruments and the role of fi-compass in supporting their effective implementation across the EU.

Day 1 focuses on setting the strategic context, with high-level discussions on key developments in shared-management financial instruments, the achievements of early pioneers, and the policy framework shaping their future. The sessions provide a common foundation for the days that follow, bringing together insights on past progress, current challenges and emerging priorities.

FI Campus 2025 – Day 2

This recording captures Day 2 of FI Campus 2025, the flagship event organised by the European Commission and the European Investment Bank (EIB) in Brussels on 25–27 November 2025, marking 10 years of fi-compass. The day brings together policymakers and practitioners to reflect on a decade of experience with financial instruments and their growing role in EU shared management.

Day 2 focuses on strategic perspectives and lessons learned, highlighting the achievements of financial instrument pioneers and exploring future directions for Cohesion Policy beyond 2027. Through plenary discussions and thematic sessions, the programme examines innovative financial instrument solutions and their contribution to competitiveness, sustainability and affordable housing, offering valuable insights for managing authorities and implementing bodies.

FI Campus 2025 – Day 3

This recording presents Day 3 of FI Campus 2025, the flagship event organised by the European Commission and the European Investment Bank (EIB) in Brussels on 25–27 November 2025, celebrating 10 years of fi-compass. The day focuses on looking ahead, combining reflections on the evolution of financial instruments with discussions on future priorities under EU policies.

Day 3 features a flexible programme of parallel sessions, allowing participants to tailor their agenda around key topics such as ESF+ financial instruments for the social economy, new equity case studies, the Savings and Investments Union, energy efficiency, greentech financing, migrant integration, urban development, and communication and visibility. The recording offers practical insights and concrete examples to support the effective use of financial instruments going forward.