| |

| |

| |

Action planning for financial instrument life cycles: new fi-compass advisory videoA newly released fi-compass video explains how to successfully plan financial instruments that use the European Structural and Investment (ESI) Funds. This new video from fi-compass provides a summary of the fi-compass publication entitled 'Developing an Action Plan'. It follows a step-by-step approach along the four main life cycle stages of a financial instrument: design, set-up, implementation, and winding-up.

Read more |

|

| |

| |

|

|

| |

| |

New advisory services for European Social Fund financial instruments The fi-compass European Social Fund (ESF) work stream has recently published new language versions of the handbook on using ESF financial instruments for promoting inclusion, sustainable jobs and better education. French, German, Italian and Spanish language versions (in addition to the original English version) of this handbook are now available for downloading and sharing through the fi-compass website’s Resource Library.

Read more |

| |

New ex-ante assessments featured on fi-compass website Member States and regions continue to advance with the set-up and implementation of financial instruments co-funded by the European Structural and Investment (ESI) Funds. Ex-ante assessments for these financial instruments have been completed for a wide range of different ESI Fund financial instruments and fi-compass is collating information that has been published about these ex-ante assessments in a new section on our website.

Read more |

|

|

|

|

|

|

| |

|

|

| |

| |

fi-compass seminar showcases financial instruments supporting urban and rural business investments On 14 March a fi-compass seminar took place in Brussels focused on financial instruments under Thematic Objective 3 (TO3) ‘Enhancing the competitiveness of small and medium–sized enterprises (SMEs)’. This event was organised to promote knowledge sharing between representatives of managing authorities and intermediate bodies about their experiences with designing, setting up and implementing financial instruments which support SME competitiveness.

Read more |

| |

EAFRD managing authorities and rural development policy benefits from fi-compass Implementing financial instruments requires specific knowledge. With the support of fi-compass, managing authorities of the European Agricultural Fund for Rural Development (EAFRD) and rural development stakeholders have a possibility to establish the necessary foundations for any future activity in this policy area.

Read more |

|

|

|

|

|

| |

|

|

| |

| |

Perspectives from France’s CAP 3RI investment platform Member States and regions can make use of financial instruments within 'investment platforms' that combine the European Regional Development Fund (ERDF) alongside the European Fund for Strategic Investments (EFSI) and national, regional and private finance. An example of how such an investment platform can work in practice is explained by the fi-compass 'Third Industrial Revolution' case study from Northern France. This ERDF financial instrument, operating in the Nord-Pas de Calais area of the Hauts-de-France region, has now started supporting investment that contributes to Thematic Objective 4 of the European Structural and Investment Funds (ESIF) and the low carbon economy.

Read more |

| |

Presidency points of view from Malta Malta currently holds the Presidency of the Council of the European Union and fi-compass spoke to Maltese stakeholders about their experiences with using EU-funded financial instruments.

Jonathan Vassallo is the Director General of Malta's managing authority for the European Structural and Investment Funds and the SME Initiative. He notes how: "When one considers the success that the implementation of financial instruments had in the 2007-2013 period, there was a natural expectation by the market that Structural Funds would again be implemented to address the persisting market gaps. When we speak about persisting market gaps here reference is made specifically to the consistently higher interest rate as well as the higher collateral requirements requested by local financial intermediaries."

Read more |

|

|

|

| |

|

|

|

| |

|

|

| |

| |

European microfinance institutions start to be certified under the European Code of Good Conduct Microfinance institutions (MFIs) have started to receive certification for compliance with the European Code of Good Conduct for Microcredit Provision (referred to as 'the Code'). The first of these was the Dutch MFI Qredits and new announcements are set to follow soon about additional MFI certifications.

Read more |

| |

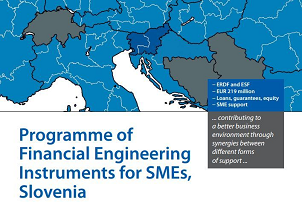

Slovenian financial instrument offers integrated package of business support sources Slovenia's experiences with a financial instrument that offered investment support from the European Regional Development Fund (ERDF) and the European Social Fund (ESF), with the corresponding national co-financing shares, are the subject of a newly-published fi-compass case study. This Slovenian 'Programme of Financial Engineering Instruments for SMEs' was designed by the Government Office for Development and European Cohesion Policy (in its capacity as managing authority) during the 2007-2013 period.

Read more |

| |

Support from Interreg Europe for projects related to financial instruments Interreg Europe funding is available for local, regional and national public authorities throughout Europe to develop and deliver better policy by sharing solutions with each other.

Read more |

|

|

|

|

|

|

|