Your questions answered - payments under the new CPR

A discussion with Oana Dordain, Deputy Head of Unit and Radka Konstantinova from the European Commission’s DG REGIO, hosted by Desmond Gardner from the fi-compass team at EIB.

Hello and welcome to a new episode of Calling the Tune, our podcast series on the new Common Provisions Regulation. I'm Desmond Gardner from the fi-compass team at the EIB. I'm joined today by Oana Dordain and Radka Konstantinova from DG REGIO, European Commission, to discuss the rules for payment under Article 92(2) of the CPR. This topic was presented at our recent ERDF conference in Brussels, and we had a number of questions, which we didn't have time to cover on the day. We will therefore discuss them today. If any listeners have further questions, please get in touch and we will try to answer them in a future episode of this podcast. Oana, Radka, welcome and thank you for joining us.

Radka: Thank you very much. I'm very happy to be with you today.

Oana: Thank you very much. I'm also very happy and I hope this podcast will be interesting for everyone.

We're recording this podcast a few weeks after the ERDF conference in Brussels. It was our first event with participants attending in person since the pandemic. How do you think it went?

Oana: It was indeed very nice to see everyone in person after such a long time. We were impressed by the number of participants, around 400 people, and we are very pleased to see more than 100 of them coming to Brussels to see us. For us, the discussions were very interesting and I hope the participants benefited also as much as we did. We hope the next FI Campus event in March 2023 we will see as many people as in Brussels.

Yeah, I agree. It was really nice to be able to interact with our stakeholders face to face again. Hopefully we will have the FI Campus event soon, where we can host a larger group. Radka, could you please introduce the topic, which you presented at the event? What are the key messages for practitioners about payments?

Radka: The rules for payments in the CPR have been completely changed and simplified in the 2021-27 programming period. The main change is that payments will be aligned with the reimbursement of eligible expenditure and there will be no more reimbursement of tranches, like it was in the 2014-20 period. However, I must tell you that we have the possibility to have first advance, which was increased to up to 30%, and that will allow for immediate liquidity boost for the financial instruments to begin.

Yeah, many thanks. Okay. So let's consider each of the key issues in turn. We received several questions from practitioners during the event and we will try to address those as the discussion progresses. So, to start things off, perhaps we can consider the scope of the rules. I think it's the case that Article 92 regulates the relationship between the European Commission and the managing authority? What does that mean for the managing authority in relation to the funding agreement?

Oana: Yes, indeed, Desmond, you are right. The CPR regulates only the relation between the Member State and the Commission. The payments between the managing authority and the bodies implementing the financial instrument can follow modalities, which are defined in the funding agreement agreed between the parties. These modalities can be different from the ones of the CPR.

And can the payment be used for management costs and fees and other liquidity purposes?

Radka: Yes, absolutely. The first payment claim bearing up to 30% advance can be used as fresh liquidity. It can be used for management cost and fees because our intermediaries have to start operating and they need to be remunerated for this. And we know in general that most of the management costs and fees are needed at the set-up of a financial instrument for selection procedures, for example, or just a general set-up. Also, the 30% advance can be used for investments to provide enough liquidity to the bodies implementing the financial instrument.

So how does that work in practice? I think the starting point is the commitment of resources by the managing authority to a financial instrument under a funding agreement. Is that correct? And what happens next?

Oana: Yes, the first step is that the funding agreement is signed. Then, the managing authority contributes to the financial instrument, and if they are paid to the financial instrument, the advance of 30% can be claimed. The important point is that the advance can be claimed to the Commission only if the contributions have been paid to the financial instrument, not only committed.

Okay, so the managing authority can initially claim up to 30% of the funds committed, if it has paid it to the financial instrument. Then as funds are disbursed and as eligible expenditure, including management costs and fees, it can make additional payment claims. Then we reach the point where 70% of the funds have been disbursed. At which point we start to talk about clearance. Now, I think ‘clearance’ refers to the process where the managing authority reports to the Commission about the 30% advance. Please can you explain how this works?

Radka: Yes, exactly. When we reach 70% of the funds in the funding agreement, we start clearing the 30% advance from the Commission’s accounts. For example, if we have a funding agreement of 100 and we have advanced 30, then when we arrive at 70 of eligible expenditure claims, then we start clearing the advance.

And someone asked during the event whether it would be possible to clear the full 30% in the last year of the eligibility period, that would be, I think, 2029.

Radka: Yes, the CPR Article 92(3) says that the amount up to 30% included in the first payment application referred to in point A of paragraph 2 shall be cleared from the Commission’s accounts no later than the final accounting year. The final accounting year would be indeed July 2029, up to June 2030. So, the amount in the first payment application, be it 30% or less, should be cleared by then, but it can be done before if the managing authority wishes so. In addition, the CPR does not stipulate if this should happen in one payment claim or more. This has to be decided by the managing authority.

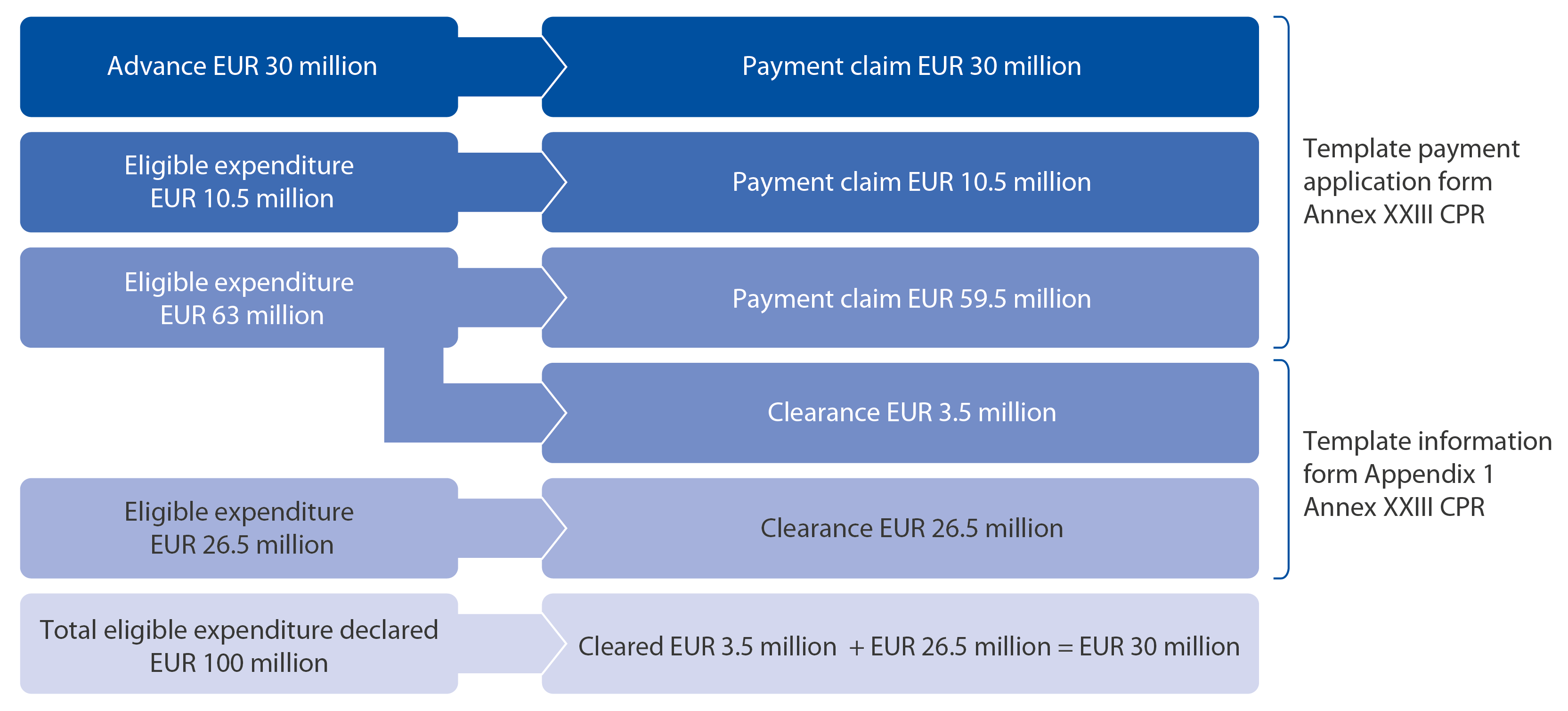

And you included an example in the presentation, which we will also publish alongside this podcast. Please can you briefly talk through the example?

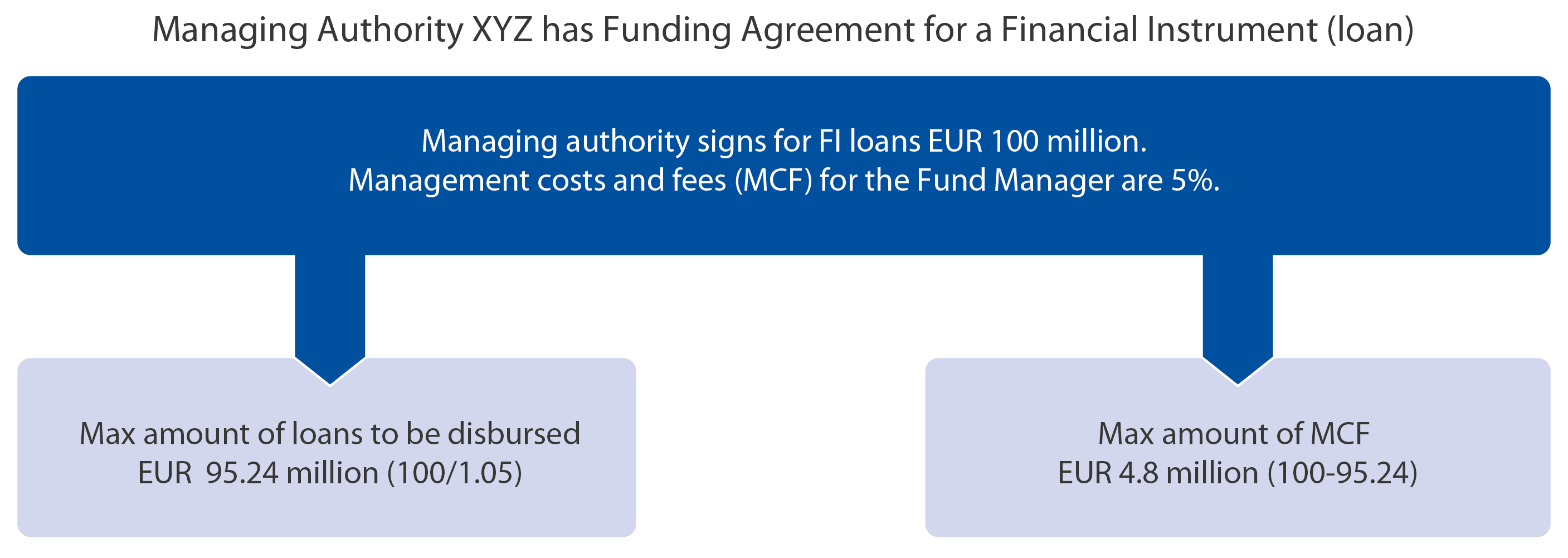

Oana: Yes, thank you, Desmond. The example looks a little bit complicated, but it is not really. So let's start explaining. The example is based on the assumption that the funding agreement was signed for EUR 100 million with a 5% of management costs and fees. So, from the beginning the managing authority knows that the maximum level of investment is EUR 95.24 million and the maximum amount of management costs and fees is EUR 4.8 million. Once the funding agreement is signed and EUR 30 million are paid to the fund manager, as we explained before, this amount can be claimed to the Commission, so it has to be inserted in the payment application in Annex XXIII and also in column A of the Appendix 1 of the same payment application. The managing authority does not have to fill in this Appendix 1 until the clearance of the advance starts. The purpose of this Appendix 1 is only to follow the clearance of the advance, as you have explained, Desmond. After, eligible expenditure starts to be incurred and amounts to EUR 10.5 million to be declared in the payment application in Annex XXIII. As I said, nothing to be declared in the Appendix 1, as the clearance didn't start. The level of eligible expenditure increases during the implementation of the financial instrument, and it amounts to EUR 63 million. With the previous payment claim, the total amount of eligible expenditure when the third payment application is to be declared arrives to EUR 73.5 million, which means that the clearance has to start, as this amount is higher than the EUR 70 million.

So EUR 3.5 million are included in column C of Appendix 1 for the clearance and EUR 63 million minus EUR 3.5 million. So EUR 59.5 million are declared as eligible expenditure in the payment application. The remaining eligible expenditure incurred of EUR 26.5 million has to be included in the Appendix 1 to show the clearance of the entire amount of EUR 30 million. But it does not have to be included in the payment application Annex XXIII, as it was already paid by the Commission with the first advance. The managing authority has the possibility to check if everything is correct by looking at the Appendix 1 where the amounts are cumulative, so the column C has to equal the column A, to show that the entire amount was cleared and the amount of eligible expenditure declared and paid by the Commission is 100, including investments and management costs and fees. I am sure that with the picture which will be published, my explanations will be clear.

That's great. Thanks, Oana. So, it's Appendix 1 of the payment application form, which is Annex XXIII of the CPR, which is used for the clearance process. So one thing that attracted a lot of interest was the discussion about the impact on the payments procedure when the amount committed under the funding agreement is either increased or decreased. What happens in these circumstances?

Radka: If the funding agreement is decreased or increased, it has no implication on the advance. Whatever amount is used as an advance, this is the amount used for clearance. According to Article 92(2A) of the CPR, there is only one first payment application of up to 30% for each funding agreement, under which the programme resources are committed. Any further changes of the funding agreement cannot have repercussions on the amounts already declared to and paid by the Commission in the first payment application. In accordance with Article 92(2B) of the CPR, all the subsequent payment claims should include the eligible expenditure, as referred.

So in answer to a specific question that was raised during the event. If the amount committed in the funding agreement is subsequently decreased, is it correct to say that the initial payment is not adjusted?

Radka: Yes, indeed, you are right. The first payment claim does not need to be adjusted in the subsequent payment claims.

That's great, thank you. And finally, I have a few more specific questions arising from the presentations. The first is to clarify what the managing authority must do before making the payment claim for the initial 30%. They must have committed the sum under the funding agreement, however, do they have to have paid the money to the body implementing the financial instrument?

Oana: Yes. The managing authority has to sign the funding agreement with the body implementing the financial instrument, and it has to commit the funds to the financial instrument. Before the advance is claimed, the contributions have to be paid from the managing authority to the body implementing the financial instrument.

And subsequent payment applications are based on eligible expenditure and I guess it's necessary that the programme resources have been paid to the final recipient at that point. So, it's not based on commitments by the body implementing financial instruments?

Oana: Yes, exactly. All subsequent payment applications after the first advance of up to 30% have to be made only with eligible expenditure incurred. This means that it can be made out of disbursements to final recipients for loans, equity or resources set aside for guaranteed contracts covering underlying disbursed investments in final recipients. It can be made also out of the corresponding grant part when applicable, and of management costs and fees. If we take a loan financial instrument, as soon as the loans are disbursed to the final recipients, the expenditure can be declared by the body implementing the financial instrument to the managing authority, together with the corresponding management costs and fees. After that, the managing authority can declare it to the Commission for reimbursement.

And finally, in relation to management costs and fees, we've already covered that the initial advance can include management costs and fees. A statement in the presentation says that the amount of management costs and fees in subsequent payments applications should comply with regulatory thresholds. What does this mean in practice?

Radka: In practice, this means that the subsequent payment applications will bear the management costs and fees, which have been agreed for a financial instrument operation depending on the implementation mode. If we have 5% management costs and fees, as per funding agreement, then we can claim that percentage in the payment application.

Many thanks. Okay, that concludes the questions asked by participants during the event. Thank you for dealing with the points in such detail; I'm sure that it will be very useful for our listeners. Before we finish, let me give you both a last word: is there any final message you would like to give about the subject of payments under Article 92?

Radka: Thank you very much, Desmond. We hope that the authorities will find the implementation of these payment rules easier this time. And of course, we stay available if there are more questions as the implementation goes ahead.

Oana: Yes, I would like to say that we try to simplify as much as possible the rules on payments between the Member State and the Commission by stimulating the implementation of the financial instrument in a sound financial way. We hope the same principles of simplification and implementation will be at the heart of the payment rules agreed at national level. We are looking forward to reply to other questions the practitioners may have encountered on the ground.

Indeed. Thank you. I would like to add my thanks to all the participants at the event, especially those who raised the questions that we have considered today. We hope very much that this podcast will be helpful for many practitioners, and we would like to give you, our listeners, the possibility to send us further questions you may have on this subject, which we will be happy to address in another episode in two-week’s time. So get in touch and write us an email to info@fi-compass.eu. So don't hesitate, we're happy to take new questions and we very much look forward to hearing from you. That brings today's episode to a close. I would like to thank Oana and Radka for joining me today.

Oana and Radka: Thank you very much, Desmond.

And the big thank you also to our listeners for tuning in today to this episode of the fi-compass Calling the Tune podcast.

If you have any questions, please send us an email at info@fi-compass.eu. Don't forget to follow us on social media too and look out for future editions of our fi-compass Jam Sessions podcast, where we will be considering the other topics featured at the ERDF Conference in October 2022. Have a good day, everybody!