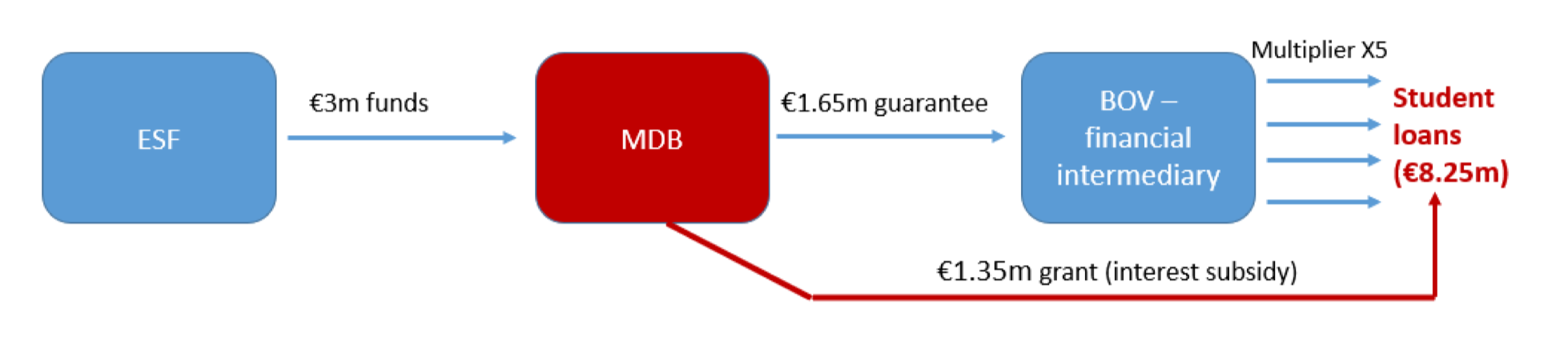

An EU-funded scheme, in the field of human capital, is implemented by the Malta Development Bank (MDB) and backed by the European Social Fund (ESF and ESF+).

The blended financial instrument combines a guaranteed loan with a grant in the form of interest rate subsidy. Over the past four years, this instrument has allowed more than 500 students finance their studies.

Following the success of the Further Studies Made Affordable (FSMA) scheme intermediated by Bank of Valletta (BOV), the successor scheme FSMA+ continued to meet the high demand for these with more than 250 loans facilities approved by end of September 2023, amounting to €10.8 million. The scheme is marketed by BOV as the BOV Studies Plus+ scheme. In addition to addressing the gap in supporting the financial needs of Maltese students, the scheme has allowed them to take up courses in innovative fields, such as environmental economics and climate change, or even health management and data intelligence.

“The FI guarantee provides additional comfort and lowers associated risk costs enabling the bank to provide preferential terms”, Marisa Said, Head of the Consumer and Microbusiness Finance Department at Bank of Valletta.

The first FSMA scheme took place between October 2019 to February 2022 and generated over EUR 9 million in new student loans. With the available funds being quickly taken up, a second, larger scheme was set up: which made available an additional loan portfolio of up to EUR 15 million.

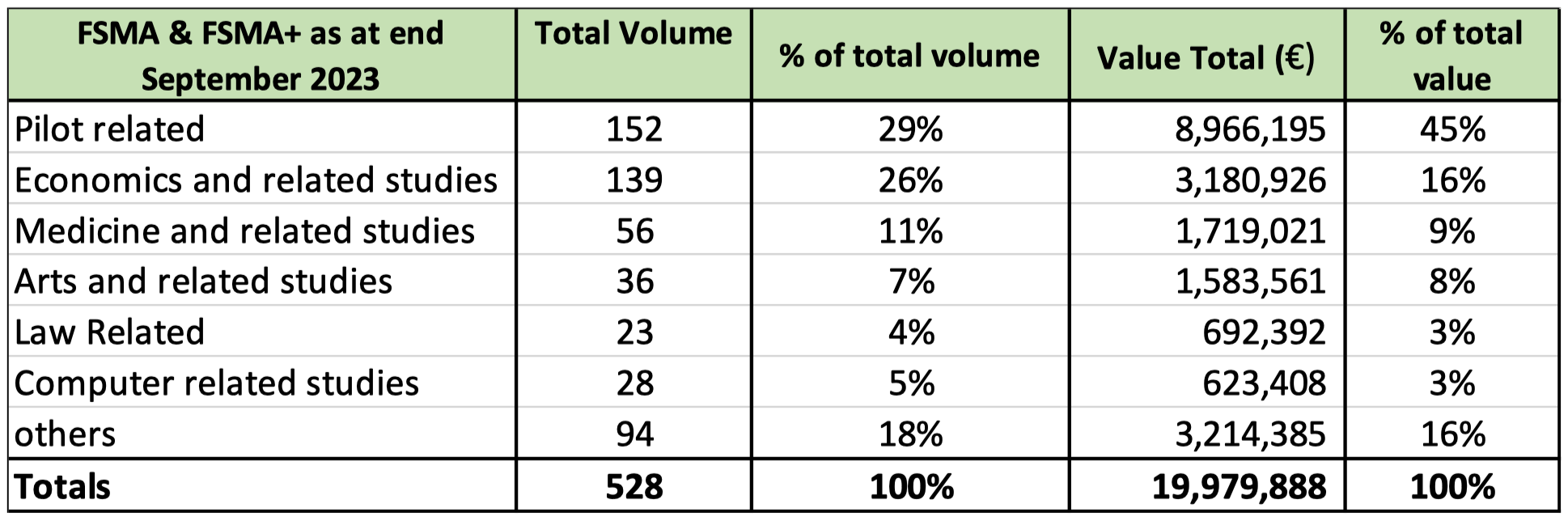

To date, under both FSMA and FSMA+, the Bank of Valletta has provided financing to over 500 students for an amount of approximately EUR 20 million.

“Our Bank supports students in various manners, including by offering them other types of student loans; but the BOV Studies Plus+ subsidised loan product has obviously become our flagship product for students pursuing studies wherein substantial financing is needed to conduct European Qualifications Framework (EQF) Levels 5 to 8 studies”, says Marisa Said, Head of the Consumer and Microbusiness Finance Department at Bank of Valletta.

The scheme was marketed primarily through digital media and presentations to universities, with 80% of all beneficiaries between 19 and 30 years old, with a median age of 25. Of this group, 40% of all beneficiaries are women. Loans ranged from EUR 3,100 to EUR 100,000 with the overall average loan size reaching EUR 33,350, "much higher than what commercial banks are willing to offer in the absence of such a guaranteed scheme", stresses Silvio Attard, a Senior EU Affairs Officer at Malta Development Bank who worked on the deal.

“The scheme made it possible for these students to follow their dreams and ultimately contribute towards a more skilled workforce”, says Marisa Said who regards the BOV Studies Plus+ Product as one of the best extensions of the Bank’s Corporate Responsibility and an integral part of the Environmental Social Governance initiatives towards BOV’s communities and customers.

The BOV Studies Plus+ product helps students access highly favourable financial terms to cover expenses related to tuition fees, as well as accommodation, living and travelling expenses if courses are followed abroad.

Tuition and accommodation fees are paid directly by BOV to the respective universities and landlords, whereas all other expenses are reimbursed by proof of receipts.

Alleviating financial obstacles to studying

Besides the change in the source of funding (from ESF to ESF+), the FSMA+ financial instrument structure (capped portfolio guarantee) including the benefits to the final recipients remain unchanged.

Thanks to the financial resources (incl. EUR 3 million for the guarantee instrument and EUR 1.65 million for the grant component) made available by the Maltese ESF+ managing authority, the instrument provides support in the form of a repayable loan to students backed by a guarantee and an interest rate subsidy funded by the ESF+ programme. Features of the product include a loan term up to 15 years, with a moratorium period (a period during which the borrower is not obligated to make payments); no additional fees and processing fees are charged, and due to the guarantee of 80% provided by Malta Development Bank, no collateral, life insurance and up-front contributions are requested from the beneficiaries.

“The financial instrument guarantee provides additional comfort and lowers associated risk costs enabling the bank to provide preferential terms”, Marisa Said, Head of the Consumer and Microbusiness Finance Department at Bank of Valletta

Besides offering a significantly reduced interest rate to students (2.7%), the FSMA+ scheme offers a moratorium on both capital repayments and interest for the period of study, and an additional 12 months upon completion of studies. Hence, the student is not required to make any payments during the period of study and will also have an additional year to seek employment. For example, if a person takes a loan to follow a one-year course, she/he will only start paying interest on the beginning of the third year.

“It is a scheme designed to fit the requirements of students at a stage of life in which they lack financial resources and require peace of mind during their studies, without the anxiety of having to cope with loan repayments”, says Silvio Attard.

“The subsidy effectively generates substantial comfort. Interest on other study loans is generally around 1.8% higher than the FSMA+, hence resulting in higher monthly repayments. Moreover, interest charged during the moratorium period is not incurred by the borrower as it is fully subsidised by the grant whose funds are largely coming from the ESF”, comments Marisa Said. She goes on to say: “In many cases any loan close to EUR 50 000 or above under FSMA+, would generally entail a maximum loan term of ten years. Based on current data at Bank of Valletta, the average loan repayment amount is slightly above EUR 400 a month”.

To date, Bank of Valletta reports that no default has been claimed under FSMA+, notwithstanding the challenging COVID-19 period and other economic factors affecting the European markets.

A market failure

The need for such a Financial Instrument in Malta was established following an ex-ante study carried out in 2018 which confirmed the existence of a market failure. According to the study, the availability of non-repayable scholarships, although on the increase, was still not meeting the demand.

The study also highlighted the insufficiency of alternative forms of assistance through private sources, leading many students not furthering their studies or not requesting more funding because the prevailing financial products were not attractive enough.

Speaking about the predecessor facility, Mr. Attard points out: “The FSMA blended scheme was a first of its kind financial instrument for Malta as well as for MDB.

Overall, we can say that its implementation process was smooth, and this is largely owed to the excellent coordination and communication between the parties involved, including the Managing Authority of EU funds, the MDB and the selected intermediating commercial bank, BOV”.

“The FSMA blended scheme is a scheme designed to fit the requirements of students at a stage of life in which they lack financial resources and require peace of mind during their studies, without the anxiety of having to cope with loan repayments”.

Silvio Attard, Senior EU Affairs Officer at Malta Development Bank

Aircraft pilot courses popularity soars

The most popular courses taken by the beneficiaries of the FSMA and FSMA+ schemes as at end September 2023 were related to aircraft pilots followed by beneficiaries studying economics or finance related subjects.

“More than half of all beneficiaries are physically studying abroad, with others following online courses with foreign universities or academies. The latter categories includes pilots who follow their courses in Malta and do not need funds for accommodation abroad. We do not have information on whether they are in employment or not, however it would be safe to say that many beneficiaries are studying on a full-time basis”, says Silvio Attard.

MDB CEO, Paul V. Azzopardi commented: “Although local educational institutions offer an increasingly varied array of study choices, students seeking specialisations in innovative sectors often need to travel abroad for their studies. This entails a significant economic outlay. With this scheme anyone can follow studies irrespective of family resources. We are very proud to assist in students’ career development through this advantageous scheme and we encourage more students to contact us, or the Bank of Valletta, to discover more about this opportunity”.

Paul V. Azzopardi, CEO, MDB